Are you seeking ways to create a steady stream of passive income? Dividend stocks can be an excellent tool in your arsenal, offering regular payouts that can supplement your existing income or even fuel early retirement. Though the allure of high returns, it's crucial to remember that not all dividend stocks are created equal. Some companies engage inflated dividends that may be unsustainable in the long term. To help you navigate this complex landscape, we've compiled a list of 10 of the highest-paying dividend stocks across various sectors.

- Acquiring these stocks allows you to benefit from both capital appreciation and consistent income streams.

- Our comprehensive analysis considers factors like dividend yield, payout ratio, and the company's overall financial health.

- Furthermore, we'll delve into the primary reasons behind these companies' strong dividend performance, delivering valuable insights for your investment decisions.

Begin your journey towards financial freedom by exploring this list of high-paying dividend stocks. Remember to conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Pinpointing the Top 100 Value Plays

In the dynamic realm of mid-cap investing, uncovering hidden gems is paramount to achieving stellar returns. This article delves into the art of "Mid Cap Mastery," providing a framework for discerning the top 100 value plays that hold the potential for substantial growth. We'll analyze key factors, such as financial stability, market sentiment, and management quality, to guide you toward profitable investments. Additionally, we'll explore proven strategies for screening mid-cap stocks that are poised for success in the years ahead.

- Utilizing fundamental analysis to uncover undervalued companies

- Reviewing key financial statements and ratios

- Identifying companies with strong revenue potential

- Executing thorough due diligence on management teams

- Observing market trends and industry developments

Embracing in Excellence: The Definitive List of 100 Top Shares

Navigating the dynamic sphere of the stock market can be a daunting task. Investors constantly seek to identify companies poised for growth and success. That's where "Investing in Excellence: The Definitive List of 100 Top Shares" comes in. This comprehensive guide offers a curated selection of the premier performing shares, meticulously chosen based on a variety of factors including financial strength, industry leadership, and future prospects.

Within its bounds, you'll unearth in-depth assessments of each company, providing valuable insights into their business. The book also includes expert commentary and actionable recommendations to help you craft informed portfolio decisions.

- If you're a seasoned trader or just starting your investment journey, "Investing in Excellence" is an invaluable resource to help you navigate the complexities of the stock market.

- Empower your understanding and take a path towards financial success with this definitive list.

Seize Market Dominance: The Definitive Guide to the 100 Best Stocks

Are you prepared to dominate the financial markets? With our meticulously curated list of the top 100 stocks, you'll gain an edge in this dynamic and ever-changing landscape. Our analysts have conducted extensive research to identify companies with immense growth potential.

This isn't just a list; it's your roadmap to financial freedom. We provide comprehensive breakdowns of each stock, including its industry performance, financial health, and future prospects. Whether you're a seasoned investor or just starting your investment journey, this resource will empower you to make strategic moves.

- Capitalize in the companies shaping our future.

- Unveil hidden gems with massive growth potential.

- Maximize your portfolio returns with expert guidance.

Unlocking the Market Landscape: The 100 Most Promising Stocks|

In the dynamic world of investing, discerning which stocks hold the potential for exceptional growth can be challenging. This latest analysis, "Portfolio Powerhouse: Unveiling the 100 Most Promising Stocks," delves into the heart of this complex landscape, highlighting the companies poised to dominate in the years to ahead.

Utilizing rigorous analysis, we've selected 100 stocks across multiple markets that exhibit impressive growth opportunities.

- From established industry powerhouses to promising innovators, this curated list offers investors a valuable overview into the future of financial success.

- Gain invaluable insights into the trends shaping these companies' growth.

- Formulate strategic investment strategies based on comprehensive evaluation.

Regardless you're a seasoned portfolio manager or just beginning your investment path, "Portfolio Powerhouse" is an valuable resource to help you navigate the opportunities of 100 top stocks today's market.

Sharpen Your Strategy: A Guide to the 100 Best Mid Cap Companies

The mid-cap market offers a unique chance for investors seeking strategic growth. These companies, typically with market capitalizations ranging from $2 billion to $10 billion, are often poised for expansion. However, navigating this ever-changing landscape can be challenging. That's where our in-depth analysis comes in. We've meticulously researched and compiled a list of the 100 best mid-cap companies, based on factors such as industry leadership, providing you with a powerful resource to enhance your investment strategy.

- Develop in-depth knowledge of the top performing mid-cap companies across various sectors.

- Discover hidden gems with high growth potential and strong fundamentals.

- Craft informed investment decisions based on data-driven insights.

Our guide offers a comprehensive overview of these companies, including their financial statements, market trends, and expert analysis. Whether you're a seasoned investor or just starting out, this extensive resource will help you improve your portfolio performance in the dynamic mid-cap market.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Angus T. Jones Then & Now!

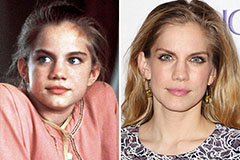

Angus T. Jones Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!